entities. Publications in recent

years indicate a close relationship between internal control and the

effectiveness of public administration. Researchers are exploring the ways in

which public sector auditing can be valuable. Research shows that the results

of internal and external audits have different effects in the public sector

than in the private sector. A review of the history of the development of the

functions of internal and external audit of the public sector shows that there

is a theory of agency and management control. Public sector auditing is an area

where additional research is needed (Hay & Cordery, 2018). Other authors

analyze the factors that contribute to increasing the efficiency of internal

audit in the public sector which would help to set proper and more transparent

governance of public financial resources. Their study investigated the

relationship between effectiveness and contributing factors. The results proved

that effectiveness has a positive relationship with internal audit quality, the

competence of the internal audit team, the independence of internal audit, as

well as with the support of internal audit from the management (Ruhani;

Vokshi & Hashani, 2017).

Postula, Irodenko

and Dube

(2020) also

discuss the efficiency of internal audit and its role in streamlining the

operations and adding value to the functioning of public administration in

Poland. The role of internal audit in public administration in Poland, as

presented in thepaper, confirms its essence and its core operational framework.

However, the mplementation of respective stages of the internal audit in the

public sector needs mproving, especially with respect to planning audit tasks

based on risks identified in the organisation being audited.

The main research

areas of 2019-2020 in matters of state financial audit are as follows:

·

research on the role of risk management, internal control and

compliance in public sector governance (Seed; Hamawandy & Omar, 2020);

·

research on the contribution of the internal audit function to the

implementation of external audit and the determination of audit fees (Saputra & Yusuf, 2019);

·

study of the moderating effect of task complexity on external

auditor’s cooperation, top management empowerment and internal auditor’s

independence, which affect internal auditor’s effectiveness (Algudah; Amran & Hassan, 2019);

· research on the

influence of digitalization on audit as a governance mechanism (Manita et al., 2020).

Scientists consider various aspects of financial control,

state financial audit, internal audit and other types of audit. In most cases (Drozd et

al., 2021; Fabiianska et al., 2021;

Khorunzhak et al., 2020; Semenyshena et al.,

2021), a study of the implementation of

financial control and its development in Ukraine is conducted; at the same

time, its further implementation is not considered, namely, the impact of

financial control (state financial audit) on the establishment and

determination of losses.

1. DATA AND METHODOLOGY

The

methodological basis of this research is general scientific methods of

cognition, special methodological techniques. To achieve the purpose of the

research, the following methods are used: concretization, analysis, induction,

deduction – when considering the components of the state financial audit,

analyzing reports of state institutions in their interrelation and system

integrity; retrospective analysis – for analyzing the performance indicators of

state institutions for the audit period (3-4 years); comparison − when

analyzing reports on the results of the state financial audits of various

Ukrainian institutions, comparing identified deviations and violations; the

method of logical generalization – when formulating conclusions.

The information

base of the research is regulatory legal acts on internal control and audit,

state financial control and audit, materials of the State Audit Service of

Ukraine, reports on the results of the state financial audits of Ukrainian

state institutions, scientific articles and reference literature on the

research topic.

2. RESULTS AND DISCUSSIONS

The

modern budget process requires compliance with financial and budgetary

discipline by all participants in the budget process, which is provided by a

system of effective and efficient control. At the same time, the main

participants in the budget process are public sector entities, as the main

managers of state funds.

Control

over the activities of budgetary institutions is, first of all, the most

important factor in strengthening public confidence in public authorities. Of

course, such control will only enjoy the trust of citizens when it is objective

and independent of those executive bodies that manage budget funds. Control is

the main independent source of information to identify the causes of violations

that occur in the management of public finances and public property.

In

recent years, Ukraine has been actively conducting state audits in the State

Audit Service of Ukraine, which is the central executive body whose activities

are directed and coordinated by the Cabinet of Ministers.

In

Ukraine, the state financial control system has three levels, namely: internal

control, internal audit, which are elements of state internal financial

control, and external control (state external financial control). To ensure the

implementation of external control at the second level, there are decentralized

internal audit units that assess and contribute to the effective implementation

of internal control, which is actually the foundation of the state.

Implementation of state policy in the field of state financial control is

provided by the State Audit Service of Ukraine, whose activities are directed

and coordinated by the Cabinet of Ministers of Ukraine through the Ministry of

Finance of Ukraine.

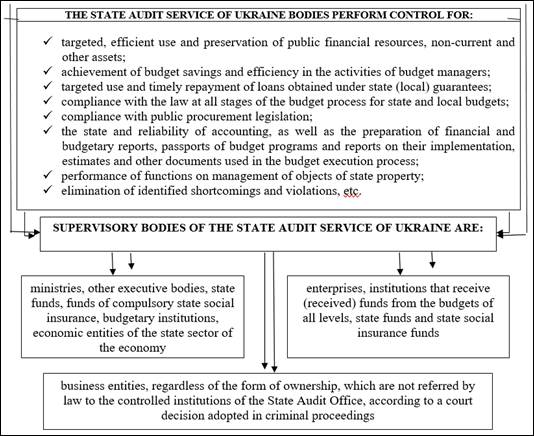

The

State Audit Service of Ukraine among various tasks exercises control over

budgetary institutions, economic entities of the public sector of the economy,

as well as enterprises, institutions and organizations that receive (received

in the period under review) funds from the budgets of all levels, implements

state financial control through the implementation of state financial audit,

procurement inspections, inspection (audit), procurement monitoring.

The

State Audit Service of Ukraine in accordance with the tasks assigned to it

exercises control over targeted, efficient use and preservation of public

financial resources, achievement of budget savings and efficiency in the

activities of budget managers, accounting, as well as preparation of financial

and budgetary reports, condition and reliability of accounting and financial

reporting, the state of internal control and internal audit of budget managers

(The State Audit Service of Ukraine, 2016).

The

main functions of the State Audit Service of Ukraine are shown in Figure 1.

The

implementation of inappropriate expenditures of budget resources in the amount

of UAH 312.7 million, illegal expenditures in the amount of about UAH 2.3

billion was established. The resource shortages in the amount of UAH 144.5

million were revealed. In general, in 2020, financial violations in the amount

of UAH 154.4 billion, in 2019 – UAH 1.7 billion, in 2018 – UAH 2.2 billion, in

2017 – UAH 1.9 billion were detected (The report of the State Audit Service Of

Ukraine,2020; The State Audit Service OF Ukraine, 2021, 2021).

Figure 1: The functional activities of the State Audit Service of

Ukraine

Due

to the need to transform the domestic state financial system, the government of

Ukraine has developed a concept for the development of state internal financial

control and approved an action plan for its implementation for the period up to

2017, and subsequently – until 2020. The main goal of this concept is to adapt

domestic legislation to European legislation, ensure proper control over the

management and use of state resources and the activities of relevant state

authorities, local self-government bodies and other institutions (Concept of

Implementation of State police in the field of reforming the state financial control system, 2020).

An important step

towards the creation of the European SFC system was the development and

implementation of the new Budget Code of Ukraine on 01.01.2011, in particular

the new version of Article 26 «Control and audit in the budget process»,

according to which the mandatory introduction of internal control and audit in

the activities of public sector entities was to take place (Budget Code of Ukraine, 2010).

According to the

results of the analysis of the state of internal control and internal audit

functioning in state bodies, conducted by the Ministry of Finance of Ukraine,

the functioning of the internal environment is generally formalized in state

bodies, control measures are implemented, internal administrative documents are

approved, relevant action plans, working groups (commissions) on the

organization and implementation of internal control are created, etc. As to the

risk management, 64 % of the surveyed state bodies have implemented a

regulation of risk management activities, 41 % made management decisions based

on the results of risk assessment and risk areas of activity, 61% documented

risk management activities. However, a number of shortcomings remain both in

the introduction of a comprehensive internal control system and in the

implementation of risk assessment of the activities of a public sector entity (Ministry of Finance of Ukraine, 2019).

It is necessary to distinguish

between the concepts of internal control and internal audit. Internal control

provides compliance with the law and efficiency of budget funds, achieving

results in accordance with the established purpose, objectives, plans, whereas

internal audit is aimed at improving the management system, internal control,

prevention of illegal, inefficient and ineffective use of budget funds, errors

or other shortcomings in the activities of the institution, providing for

independent conclusions and recommendations (Budget

Code of Ukraine, 2010).

A similar situation has occurred regarding the understanding of

the essence of internal audit, which is perceived as:

-

an audit:

· conducted by

internal auditors in budgetary institutions that has much in common with the

activities carried out by the State Audit Service of Ukraine;

· that consists

only in checking the targeted use of budget funds, compliance with the current

legislation and the reliability of accounting and reporting;

· that identifies

violations caused by minor errors in documents or processes;

· that solves

problems that already exist in the entity's activities, rather than preventing

them;

· internal control

carried out by the relevant employee in relation to the financial and economic

activities of an enterprise, organization, or institution (Internal Audit,

2020).

According

to the results of surveys conducted within the framework of the LOGICA project,

structural divisions for internal audit were created in only 0.5% of local

authorities and 0.4% of budget managers, positions of internal audit

specialists were introduced in only 42 budget managers out of 18,657

respondents. In addition, in 126 budget managers out of the total number of

respondents, the responsibility for performing internal audit functions is

assigned to officials who already perform other functions, which indicates a

violation of the independence of the internal auditor (Internal Audit, 2020).

In

accordance with the Budget Code of Ukraine and the Regulations of the Ministry

of Finance of Ukraine, the Ministry of Finance of Ukraine ensures the formation

and implementation of public policy in the field of public internal financial

control, determines organizational and methodological principles and assesses

the functioning of internal control and internal audit systems.

According

to the Budget Code of Ukraine, budget managers, represented by their heads,

organize internal control and internal audit and ensure their implementation in

their institutions and enterprises, institutions and organizations belonging to

the sphere of management of such managers of budget funds. The Ministry of

Finance of Ukraine conducted an analysis of the functioning of internal control

and internal audit in government agencies (ministries, other central executive

authorities, regional and Kyiv city state administrations, other main managers

of state budget funds) in 2020. The results of such an analysis showed further

progress in reforming the system of public internal financial control in

general and development of internal control and internal audit.

In particular, there are a number of positive developments in the

organization and implementation of internal control, including through the

formalization of elements of internal control, their components and ensuring

practical application in the performance of functions and tasks. Thus, in 2020,

budget managers took measures to improve the internal control system, in

particular:

· separate working

groups/commissions on the organization and improvement of internal control and

risk management are created by separate managers;

· adopted internal

administrative documents on issues of risk management activities;

· new control

measures have been introduced or existing ones have been improved;

· approved action

plans to improve the functioning and implementation of the system internal

control, control of risk response;

· training events

were held, etc.

At the same time, the activity of organizing internal control

did not acquire signs of systematic, integral work. However, typical

disadvantages are:

· providing the

integrity of the internal control system (its elements are fragmentary, operate

separately from each other);

· lack of unified

approaches to business planning;

· consideration of

internal control as a separate activity or measure (management control,

supervision, control over the process of using budget funds, etc.);

· risk management

and monitoring activities are not integrated into the management cycle and do

not focus on key risks that may arise in the process of performing the main

tasks.

The

system of internal control is mainly built around compliance with relevant

regulations. Control measures do not focus on the effectiveness of key

processes, but on the use of budget funds, management of state property and

other resources. In the reporting year, a number of government agencies took

into account the recommendations of the Ministry of Finance and provided

organization of internal audit activities in accordance with the established

requirements, for example:

· measures have

been taken to ensure the independence of internal audit units;

· the capacity of

internal audit units has been increased and the positions of internal auditors

have been filled;

· improved

approaches to planning internal audit activities;

· measures have

been taken to change priorities during internal audits (in particular, the

share of internal audits in assessing effectiveness continues to grow);

· improved

approaches to ensuring and improving the quality of internal audit, etc.

The

results of the assessment of the functioning of the internal audit system of

public sector entities are shown in table. 1.

The

activities of the State Audit office of Ukraine in terms of assessing the

internal control system can be traced at the sectoral level, for example, the

results of the audit of health care facilities. Appropriate internal audit

measures are recorded in the activities of the Ministry of Health of Ukraine.

The Operational Action Plan for Internal Audit of the Ministry of Health of

Ukraine for 2019 has been prepared taking into account the tasks and results of

the Strategic Action Plan for Internal Audit of the Ministry of Health of

Ukraine for 2019-2021. However, the practical results of the state audits conducted

in 2019 indicate the presence of violations in the use of funds allocated for

the maintenance of health care facilities, in accordance with the established

estimates.

Table 1: The results of activity of

internal audit in central executive bodies and regional state administrations *

|

Type of audit

|

The nature of the violations

|

Year

|

|

2017

|

2018

|

2019

|

2020

|

|

Financial audits/compliance audits

|

violations that led to the loss of resources (illegal,

non-targeted costs, disadvantages, shortage of resources), UAH million

|

|

central executive bodies

|

1396,2

|

933,9

|

1,1 billion

|

13

billion

|

|

regional state administrations

|

216,2

|

270,4

|

388,5

|

91,7

|

|

Violations that did not lead to loss of resources

(overstatement of liabilities, overstatement of the need for budget funds,

understatement of assets, surpluses, diversion of funds into receivables,

maintenance of excessive units, etc.), number, thousand

|

|

central executive bodies

|

6,4

|

4,9

|

57,8

|

44,9

|

|

regional state administrations

|

0,5

|

1,0

|

3,8

|

1,7

|

|

non-financial violations, number (violation of the order

of accounting, inaccuracy of financial and budgetary reporting,

non-compliance with legislation, plans, administrative documents, etc.)

|

|

central executive bodies

|

13,4

|

15,5

|

Reflected as part of violations that did not lead to loss

of resources due to changes in the method of presenting information

|

|

regional state administrations

|

1,8

|

2,6

|

|

|

Losses reimbursed, amount, UAH million

|

|

central executive bodies

|

179,7

|

364,6

|

no data available

|

359,3

|

|

regional state administrations

|

8,9

|

22,4

|

no data available

|

21

|

|

level of loss compensation, %

|

|

central executive bodies

|

13

|

39

|

17,8

|

2,8

|

|

regional state administrations

|

4

|

8

|

7

|

22,9

|

*Source: summarized by the authors using database of

Ministry of Finance of Ukraine (2021)

It should be

noted that some violations are similar in nature, as evidenced by the results

of audits of other health care facilities, which are summarized on the basis of

processing of reports on the results of public audits. It should be noted, that

in table 2 included only violations that exceed the threshold of 200 thousand

UAH, although there is a significant number of violations with less monetary

expression.

As you can see,

the lack of properly organized internal control system made it impossible to

prevent violations and shortcomings in the financial and economic activities of

the institution, which affected its completeness of income generation, the

effectiveness of expenses incurred and the formation of financial results.

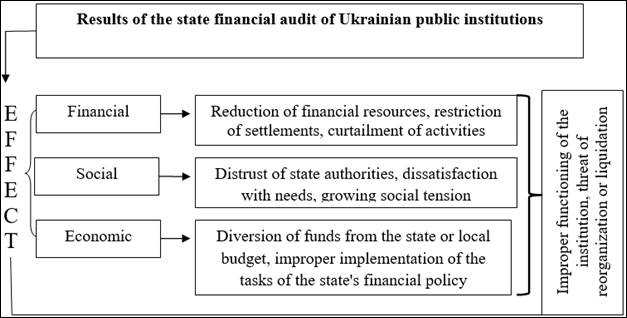

Based on the results of the table 1 and table 2, typical violations in the

organization and maintenance of accounting and internal control system of are

summarized and the impact of inefficient organization of internal control

system in the form of financial, social and economic effects is illustrated (fig.

2).

Figure 2: Impact of inefficient organization of internal control

system for the activities of public institutions

*Source:

summarized by the authors

A significant role has to be assigned to control

measures, which are a set of introduced management actions carried out by the

management and employees of the institution to influence risks in order to

achieve certain goals and objectives of the institution. Typical

control measures to ensure the reliability of accounting and reporting data

are:

· obtaining permission from responsible officials to perform

operations through approval procedure;

· delineation of responsibilities among employees to reduce the risk

of making mistakes or committing illegal actions;

· control over access to tangible and intangible resources, accounts,

etc.;

· establishing rules and requirements for performing operations and

monitoring the legality of their implementation;

· reconciliation of credentials with actual data;

· assessment of the overall performance of the institution;

· monitoring the implementation of assigned tasks, etc.

3. CONCLUSIONS AND RECOMMENDATIONS

With the increasing scale

of public sector entities of various forms of ownership and the creation of a

competitive environment, comprehensive control over the processes taking place

within the institution is possible only through the creation of an effective

system of internal control and active implementation of internal audit. It is

internal control as an important tool of the enterprise management system with

the help of special procedures and a set of control actions helps to ensure the

effective implementation of tasks.

The latest challenges of

state financial control in Ukraine indicate the urgent need to develop internal

control and internal audit of public sector entities as tools of the management

system, which through special procedures and a set of control actions help to

ensure the effective implementation of the assigned goals and objectives. Now,

there are a number of factors that slow down their full functioning, in

particular, insufficient awareness of their progressive role by the management

of the budget manager, erroneous identification with other types of control,

lack of recording the results of their implementation, management reporting,

etc.

Analysis of the results of state

financial audits in Ukraine revealed typical violations in accounting and

internal control, among which the most common are shortfall in income,

inefficient use of financial resources, overestimation of the salary fund; lack

of provisions on structural divisions, non-compliance of certain provisions of

the order on accounting policy with the current requirements of the

legislation, etc. The presence of similar violations in different state

institutions indicates their uniformity and inhibition of decision-making to

solve problems at the industry level.

The identified amounts of financial violations

significantly affect the financial stability of the industry and the state. It

is proposed to consider such an impact in the form of financial, social and

economic effects, such as diversion of funds from state or local budgets, inefficient

implementation of state financial policy tasks.

The results of the study are important for identifying

and assessing risks in the activities of public institutions and developing

measures to prevent them. Generalized and defined typical violations in

accounting and internal control system of public institutions allow us to take

them into account in the process of developing proposals and recommendations

for:

Table 2: Analytical summary of the results

of the state financial audit in 2019 on the example of health care facilities*

|

Audit entity

|

The period covered by the audit

|

The nature of the violation

|

The amount of financial losses

|

The total amount of financial losses

|

|

Department of Health and Civil

Protection of Zalishchyk District State Administration

|

2019

|

Additional non-targeted spending

|

3,4 UAH million

|

7,613 UAH million

|

|

Payment of fines and penalties

|

513 thousand UAH.

|

|

Loss of assets due to incorrect

accounting

|

3,7 UAH million

|

|

Municipal non-profit enterprise

"Vinnitsa City Clinical Hospital №1"

|

during 01.03.2016 - 31.07.2019

|

Financial violations

|

5,2 UAH million

|

5,2 UAH million.

|

|

Borznianska Central District

Hospital

|

during 01.01.2015 -31.07.2019

|

Loss of financial and material

resources

|

453,1 thousand UAH

|

453,1 thousand UAH

|

|

Municipal institution "Maternity hospital

№7" (Odessa)

|

01.06.2013 - 31.12.2018

|

Violation of financial

discipline

|

321,39 thousand UAH

|

1,0 UAH million

|

|

Municipal institution "Maternity hospital

№1" (Odessa)

|

during 2017-2019

|

Reimbursement of the special

fund at the expense of the general fund

|

471,8 thousand UAH

|

|

Municipal institution "Maternity hospital

№2" (Odessa)

|

2018

|

Over-fulfillment of balances

allocated from the local budget to pay for medicines and medical supplies

|

216,5 thousand UAH

|

|

Volyn Regional State Administration Health Department

(Budget program "Creation of blood banks and its components")

|

during 01.01.2016-30.09.2018.

|

Inefficient use of funds for

wages

|

115,8 thousand UAH

|

1137,9 thousand UAH

|

|

Excessive accrual and payment of

wages

|

802,0 thousand UAH.

|

|

The single social contribution

is overpaid

|

220,1 thousand UAH.

|

|

State enterprise «Ukrvaktsina»

|

01.01.2018

|

Availability of expired drugs in

the warehouse, inefficient procurement management

|

10949,6 thousand UAH

|

10949,6 thousand UAH

|

*Source: summarized by the authors using database of the

State Audit Service of Ukraine (2021).

elimination of violations and shortcomings identified

during the audit and prevention of them in the future in the industry's

activities;

· elimination of the causes and conditions that

have led or may lead to violations and shortcomings in the activities of public

institutions;

· improving the efficiency and effectiveness of

activities of public institutions;

· increasing the responsibility of managers over

the effectiveness of their management decisions and performance of activities.

The areas of further

research are: development of draft documents to improve the system of

accounting and internal control for public sector entities; development of

methods for identifying risks of activities in accounting and internal control

(audit); development of proposals at the industry level to prevent violations

in the accounting and internal control system, which are systemic.

REFERENCES

Algudah, H. M., Amran, N. A., & Hassan, H. (2019). Factors

affecting the internal auditors’ effectiveness in the Jordanian public sector:

The moderating effect of task complexity. EuroMed Journal of Business, 3, 251-273. Retrivied from:

https://www.deepdyve.com/lp/emerald-publishing/factors-affecting-the-internal-auditors-effectiveness-in-the-jordanian-mKLlxd4bxq.

Antoniuk,

O., Chyzevska, L., & Semenyshena, N. (2019). Legal Regulation and Trends of Audit Services:

what are the differences (evidence of Ukraine). Independent Journal of Management &

Production, 10(7),

673-686. DOI: http://dx.doi.org/10.14807/ijmp.v10i7.903.

Antoniuk,

O., Kutsyk, P.,

Brodska, I., Kolesnikova, O., & Struk, N. (2021). Institutionalization

of Accounting and Auditing Services in Ukraine: Genesis, Evaluation, Analysis. Independent Journal of Management & Production, 12(3), s123-s137. DOI:

https://doi.org/10.14807/ijmp.v12i3.1530

Antoniuk, O., Kuzyk, N., Zhurakovska, I., Sydorenko, R., & Sakhno, L. (2020). The

Role of «Big Four» Auditing Firms in the Public Procurement Market in Ukraine. Independent Journal

of Management & Production, 11(9), 2483-2495.

DOI: http://dx.doi.org/10.14807/ijmp.v11i9.1432.

Budget Code of Ukraine (2010). Law of Ukraine dated

08.07.2010 № 2456-VI. Update date: 01.01.2021. Retrivied from: https://zakon.rada.gov.ua/laws/show/2456-17?lang=en#Text. Access: June 01, 2021

Concept of Implementation of State Police in the Field of

Reforming the State Financial Control System (2020). Concept of

implementation of state policy in the field of reforming the state financial control

system until 2020: Order of the Cabinet of Ministers of Ukraine dated

10.05.2018 № 310-r. Retrivied from: https://zakon.rada.gov.ua/laws/show/310-2018-%D1%80#Text. Access: June 01, 2021.

Drozd, I., Pysmenna, M., Pohribna, N., Zdyrko, N., & Kulish, A. (2021). Audit Assessment of the Effectiveness of Public

Procurement Procedures. Independent

Journal of Management & Production,

12(3), s085-s107. DOI: https://doi.org/10.14807/ijmp.v12i3.1522

Fabiianska, V., Kutsyk, P., Babich, I.,

Ilashchuk, S., Voronko, R.,

& Savitska, S. (2021). Auditor's Professional Skepticism: a Case from Ukraine. Independent

Journal of Management & Production, 12(3),

s281-s295. DOI: https://doi.org/10.14807/ijmp.v12i3.1529.

Hay, D.,

& Cordery, C. (2018). The

value of public sector audit: Literature and history. Journal of Accounting

Literature, 40, 1-15. Retrivied from:

https://doi.org/10.1016/j.acclit.2017.11.001. Access: September 18, 2021

Internal Audit (2020). Internal audit: from theory to

practice: practical guide. Kyiv. Retrivied from:

https://decentralization.gov.ua/uploads/library/file/557/30.03.2020.pdf.

Khorunzhak,

N., Belova, I., Zavytii, O., Tomchuk, V., & Fabiianska, V. (2020). Quality Control of Auditing: Ukrainian Prospects. Independent Journal of Management & Production, 11(8), 712-726. DOI: dx.doi.org/10.14807/ijmp.v11i8.1229.

Manita, R., Elommal, N., Baudier, P., & Hikkerova, L. (2020).

The digital transformation of external audit and its impact on corporate

governance. Technological Forecasting and Social Change, 150. Retrivied from: https://www.sciencedirect.com/science/article/abs/pii/S0040162518320225. Access: June 11, 2021.

Ministry of Finance of Ukraine (2019). Information on the state

of internal control and internal audit in 2019. Ministry of Finance of

Ukraine. 2020. Retrivied from: https://www.mof.gov.ua/uk/news/funktsionuvannia_derzhavnogo_vnutrishnogo_finansovogo_kontroliu_u_2019_rotsi-2127 Access:

12.04.2021.

Postula, M., Irodenko, O., & Dube, P. (2020). Internal Audit as a Tool to Improve the

Efficiency of Public Service. European Research Studies Journal, XXIII (3),

699-715. Retrivied from: https://www.academia.edu/43444386/Internal_Audit_as_a_Tool_to_Improve_the_Efficiency_of_Public_Service?from=cover_page.

Access: September 15, 2021.

Ruhani, L. H.,

Vokshi, N. B., & Hashani, S. (2017). Factors contributing to the

effectiveness of internal audit: case study of internal audit in the public

sector in Kosovo. Journal of Accounting, Finance and Auditing Studies,

3(4), 91-108. Retrivied from: https://www.um.edu.mt/library/oar/handle/123456789/27336. Access: September 02, 2021.

Saputra, I. G., &

Yusuf, A. (2019). The Role of Internal Audit in Corporate Governance and

Contribution to Determine Audit Fees for External Audits. Journal of Finance

and Accounting, 1, 1-5. Retrivied from:

http://www.sciepub.com/JFA/abstract/10136.

Seed, S., Hamawandy, N. M., & Omar, R. (2020). Role of internal and external

audit in public sector governance. A case study of Kurdistan regional

government. International Journal of Advanced Science and Technology,

8s, 1452-1462. Retrivied from: http://sersc.org/journals/index.php/IJAST/article/view/12528. Access: April 12, 2021.

Semenyshena, N., Khorunzhak N., Lazaryshyna, I.,

Yurchenko O., Ostapenko Y. (2021). Accounting Institute:

on the Genesis and Impact of Management Revolutions.

Independent Journal of

Management & Production, 12(3),

s243-s261. DOI: https://doi.org/10.14807/ijmp.v12i3.1540.

The Report of the State Audit Service of Ukraine (2020). Report

on the results of the State Audit Service of Ukraine, its interregional

territorial bodies for 2019-2020. Retrivied from: https://dasu.gov.ua/attachments/analytical-reports/2019/897f4ba0-b223-4638-93a5-2b7ba5cd1bd3_158169.pdf.

The State Audit Service of Ukraine (2016). Regulations on the

State Audit Service of Ukraine: Resolution of the Cabinet of Ministers of

Ukraine dated 03.02.2016 № 43. Update date: 11.09.2020.

Retrivied from: https://zakon.rada.gov.ua/laws/show/43-2016-%D0%BF#Text. Access: April 12, 2021.

The State Audit Service of Ukraine (2021). Report on the

results of the State Audit Service of Ukraine, its interregional territorial

bodies for 2020-2021. Retrivied from: https://dasu.gov.ua/attachments/41c93f15-7eb7-49ab-b464-1934173c7f58_%D0%97%D0%92%D0%86%D0%A2__2020_%D1%80%D1%96%D0%BA.pdf.

DEVELOPMENT OF INTERNAL CONTROL AND AUDIT IN UKRAINE

DEVELOPMENT OF INTERNAL CONTROL AND AUDIT IN UKRAINE