of the development of the accounting

system, in our opinion, is a source of formation of its new concepts,

principles, functions, methods and techniques. In addition, the most important

result of such research may be the formation of a new theoretical paradigm and

the development of innovative methodology based on the use of trends not only

in accounting but also a set of basic sciences, including modern information

systems, modeling theory, mathematical statistics and others.

The

relevance of such a study is enhanced by decentralization processes and its

results in Ukraine. The relevance of such a study is enhanced by

decentralization processes and its results in Ukraine. To confirm, we present

the results of polls conducted by the Ilko Kucheriv Democratic Initiatives

Foundation together with the Razumkov Center's sociological service. The survey

was conducted from 14 to 19 August 2020 in all regions of Ukraine except the

Crimea and the occupied territories of Donetsk and Luhansk regions. 2,022

respondents over the age of 18 were interviewed by face-to-face interviews at the

place of residence of respondents in a sample representing the adult

population. The theoretical sampling error does not exceed 2.3%.

Survey

results:

Since the beginning of the

decentralization reform in 2015, local budget revenues have increased significantly.

Have you felt any results of using these funds (improving the quality of

services, landscaping, social assistance) during this time?

Table 1: Have you felt any results

of using these funds during this time?

|

|

August 2016

|

June 2017

|

August 2018

|

August 2020

|

|

Yes,

I felt some changes for the better

|

16,2

|

16,5

|

18,2

|

26,8

|

|

No,

I did not feel any changes

|

67,2

|

55,4

|

60,8

|

46,7

|

|

I

only felt the change for the worse

|

8,4

|

16,4

|

13,9

|

12,1

|

|

Hard to tell

|

8,2

|

11,7

|

7,2

|

14,3

|

Source:

Razumkov Center's (2020)

We believe that such not very optimistic results of

decentralization in Ukraine are due to the shortcomings of the accounting

system in the public sector. Despite its reform, carried out in accordance with

the approved Accounting Modernization Strategy, it is not a sufficiently

effective source of information for management and control. Which negatively

affects the results of decentralization.

The

history of accounting, which is studied by many Ukrainian and foreign scholars,

in this context is an important tool to improve the quality of this system and

strengthen its control function. The value of scientific understanding of the

historical development of the principles of accounting is explained by the

important role of history in determining the possibilities for further

improvement of accounting.

1.

LITERATURE REVIEW

Studies of specialized literature

sources that cover the issues of public property accounting (starting with

community property), and which in one way or another in connection with the

systemic transformation of management and development of state institutions

relate to accounting in budgetary institutions indicate that the discussion of

the role of management in the formation of the accounting system is not

completed. The issue of the date of occurrence

of accounting in the public sector has also not been resolved.

In

particular, Svirko (2006) notes that an important point should be the starting point of the

formation of the Ukrainian state and argues for his position. Thus the

scientist gives the detailed list of information sources and the characteristic

of features of development of the account, since VI century. to this day.

The

opinion that the accounting of public property originated in the primitive

communal system is also entitled to exist. Thus, Marx (1885) noted that already in the oldest communities there is an accountant and

accounting is a function of the official of the community. That is, the need

for accounting is related to the need to register the economic facts that were

carried out within the social structural unit, and therefore it is more

appropriate to consider it as a practical activity. Nevertheless, this period

should be positioned as a stage in the emergence of community accounting.

However,

we believe that it is more important not to establish the date of birth of

accounting, but to investigate how its content and organization depended on the

managerial revolutions. This

position is not new, because many scientists emphasize that it is the

management system that determines what should be the accounting and what

accounting data are needed to make management decisions.

In

particular, recent research on this issue has been conducted by Rasid, Saruchi

and Tamin (2019). In it, the authors argue that the awakening of modern

technology in the era of this 4th Industrial Revolution (4IR) has had a

tremendous impact on the entire landscape around the world, including the

business sector. To be aligned with the technological advancements, management

accountants have to keep proactive and prepare for any unexpected changes to

ensure that their business remains lucrative and stays relevant in the

industry.

Nonetheless,

the changing role of the management accountant due to the presence of 4IR is

imminent. As a result, this paper deliberates on how the 4IR changes the role

of management accountants, including what knowledge and skills are crucial for

them to grasp in order to adapt adequately in this 4IR era. In addition, this

paper also reviews the challenges that they have to face. The study can be of

prime importance to business firms in identifying the role of the management

accountant in this 4IR era and to prepare for the ubiquitous challenges that

may perturb their efficacies. Agreeing with this

position, it should be noted that we believe that every management revolution

has had its impact on accounting. Proof of this is the development of

management accounting. The principled position on the purpose of such accounting is laid down

even in its name.

Without going into a detailed review

of the stages of development of management accounting and its basic concepts,

which are described in detail by many other scholars and practitioners, such as

Kaplan (1984) and others, we note that management accounting in the public

sector is insufficiently studied.

Instead, the history of accounting

shows that each new stage is appropriately linked to the transformational

changes that take place in the management system and that affect the purpose,

objectives, principles and functions of accounting.

2.

METHODOLOGY

The methodological basis of the

study is the dialectical method of cognition. The use of the historical method

allowed to establish the logical dependence of the evolution of accounting on

the requirements of the management system. Analytical and systematic methods

were used to identify and form descriptions of the relationship of the

accounting system in budgetary institutions with the processes of management

system transformation and management revolutions.

3.

RESULTS

3.1.

Systemic transformation of

management (managerial revolutions) and its impact on accounting in the budget

sphere

The

process of targeted and structural change of management approaches can be

positioned as a systemic transformation of management, which is a factor that

has a direct impact on the development of accounting methodology. Therefore, it

is advisable to distinguish the stages of its development in accordance with

the sequence of changes in management requests (depending on the change of

management requests and purpose) and the corresponding formation of new

accounting characteristics.

Agreeing

with the predicted debatability of the author's position, it should be

emphasized that it is important in terms of historical background and role in

the process of understanding the development of accounting as a professional

activity and science. In this regard, the existence of the concept in question

has its meaning, and therefore it should be specified by providing appropriate

characteristics.

In

the modern scientific literature, considerable attention is paid to ensuring

the appropriate adequacy of information produced by accounting, and the

problems of its compliance with the requirements of the management system. It

is fair to recognize the impact of the latter on the system characteristics, as

well as the tasks, methodology and organization of accounting.

This

is confirmed by the historical development of not only the theory but also the

practice of its conduct, comparing the characteristics of accounting in

different historical periods, in particular after the administrative

revolutions. It is fair to say that in various scientific sources there is no

consensus on the number and types of such revolutions.

The basis of our study is the

position of Novychkov (2007), who scientifically

substantiated the existence of ten administrative revolutions. Thus, the emergence of accounting from a theoretical

point of view is considered the first stage of its development. Its

characteristic features are: the need for knowledge about the volume of objects

of accounting; possibility to save information; motivation to control values

(a certain stock of products is required for survival).

The

given characteristics are quite logical to carry to the plane of performance

taking into account the information function (3rd century

BC). This stage is characterized by the fact that it belongs to the period of

the first administrative revolution, which was called organizational and state.

It is she, in our opinion, became the basis for the emergence of accounting for

community property.

The

transformation of management structures, in particular the transition from individual

to public management required new approaches to the formation of information.

The mere availability of data on the amount of resources no longer met the

needs of management. There was a need to manage the use of resources, which

involved the formation of data on the directions of their consumption.

Evidence

of the actualization of this problem was the beginning of the activities of

managers-functionaries. Accounting began to play the role of an information

source of community property management. Accordingly, a certain accounting

structure began to form, which, in addition to information on income and

expenditure for control purposes, began to serve as a basis for planning and

forecasting. The management vertical of the accounting information movement

appeared and the consolidated information began to be formed.

The

second administrative revolution (religious-commercial) is associated with the

transition to a centralized management structure and the participation of

government agencies in commercial operations. This required the formation of

information to which external interested users would have access. However,

because the storage media was not compact, access to such information was

limited.

A

peculiar way out of the situation was the emergence of the first written

accounting records on papyrus, which provided for the grouping of objects of

accounting. The complication of the

management structure of the community hierarchy from the grassroots management

functions has led to improved accounting, the emergence of systematic records

and compilation of data. This allowed you to control the status and volume of

objects and their groups, as well as generate generalized data. A

characteristic feature of this historical period of development of accounting

was the transition from private management (in a separate subsistence economy)

to the formation of elected boards and their officials (magistrates), who were

in charge of certain industries, including finance, military affairs, courts,

taxes, etc. (Figure 1).

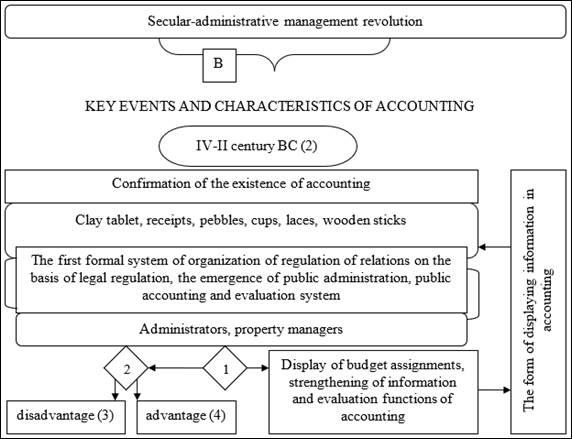

Defined

in Figure 1 characteristic features of accounting confirm the position that the

first stage of its development in the historical period (before the V century

BC) corresponds to a change in the organization of public life in accordance

with the emergence of state principles (ancient Egypt, Sumer, Chersonese) and

two administrative revolutions (organizational-state and religious-commercial),

which required the formation of social information and control over the use of

common property.

Therefore,

this stage can be considered religious and commercial and positioned with the

emergence of the information function of accounting and the formation of the

principles of data collection. To achieve this function of accounting and

generalization of information, as evidenced by studies of historical sources (Jäger, 2010; Leyerer, 1919), there are

appropriate prerequisites: responsible persons (managers) and primitive written

reflection of accounting transactions.

Figure 1:

Characteristic features of accounting for the period of the first and second administrative

revolutions

The third administrative revolution

(secular-administrative) led to the strengthening of the role of the state in

the management of finances and activities of state institutions, and also

served as a basis for regulating the whole complex of social relations,

including the development of social protection, application of motivation. This

became the basis for further development of the information function of

accounting. But at the same time, it became the basis for the emergence of

valuation as an element of the method of accounting. This stage falls on the

second century BC. Its characteristic feature is the formation of the first

formal organization of regulation of relations in the field of accounting, as

well as the transfer of managerial powers from priests to government officials

(holders of state power) (Figure 2).

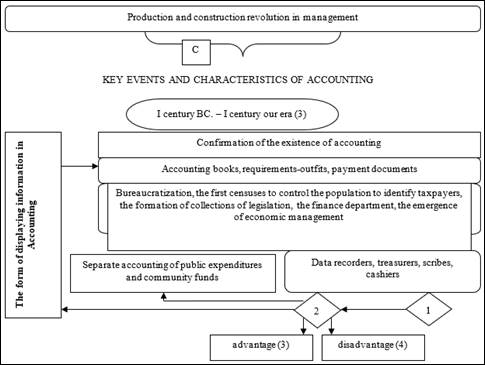

Figure 2:

Characteristics of Accounting in Period of the Third Administrative Revolution

The

centralization of power that took place during this period required a

concentration of information on government spending. During the period under

review, accounting is closely linked to the registration of estimates for the

distribution of public funds.

The

basis for establishing the directions of their use are regulatory documents

(decrees, orders). Although these were mainly decisions made by tsarist

individuals alone, they were public in nature and concerned the organization of

meeting various needs for the community (including the maintenance of troops,

doctors, courts, etc.).

Despite

the peculiarity of primitiveness, which is manifested in the ways and methods

of ensuring revenues to the treasury and their reflection in the books, the

achievement of this period of historical development is that relations are beginning

to develop, which in later times were called public finance.

Accounting in this

period becomes regulatory. Its key feature in relation to public expenditures

is the centralization of management, the presence of persons responsible for

the payment and accounting of taxes. This stage is associated with

strengthening the social role of accounting for the population, the emphasis on

the use of separate accounting of different farms and the implementation of

control procedures, in particular the use of such an element of the method of

accounting as inventory.

Thus, there is a

development of both the management system and accounting as its main source of

information. In particular, the regulation of accounting begins and the

obligation to keep it is established, as well as the main components are

determined - the balance sheet, state accounting books. In general, accounting

is made more suitable for control, management and regulation (Figure 3).

State attention at this

time was paid to the collection of taxes and the distribution of collected

resources for public needs. The emergence of treasurers indicates the

transformation of the management system, the essence of which is to impose

responsibilities for the collection and distribution of public funds to those

responsible at the executive level. In this context, accounting has begun to

play a regulatory role.

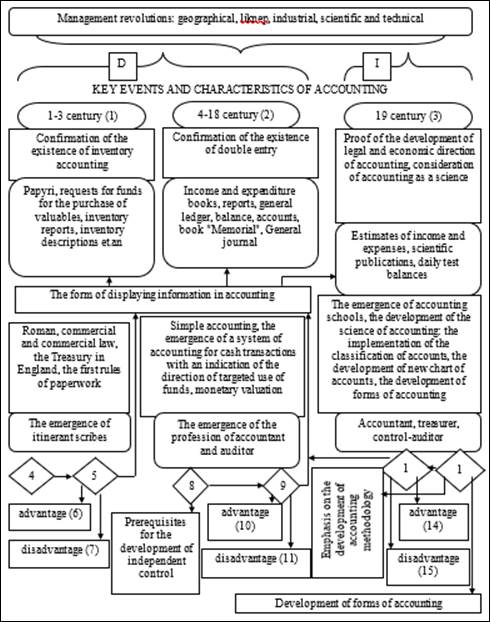

Historical period of

I-III centuries distinguished by the advent of Roman law, itinerant scribes

(prototype of hired accountants), as well as the development of the treasury

(in England). This time period is the origin of monetary relations (including

the use of various items to provide them - animal fur, metal axes, etc.). In

the classical sense, the first banknotes in Ukraine appeared during the reign of

Volodymyr Sviatoslavovych the Great (980-1015).

These were the so-called "gold

coins" and "silver coins" (gold and silver coins). Prior to

that, the issues of Greek colonies, coin products of ancient Rome, Arab

dirhams, etc. were used in our country. In the accounting system, the emergence

of money has led to the development of the reflection of exchange equivalents,

i.e. to the use of cost measures. In the IV-XVIII centuries. simple accounting

is conducted, there are requirements for the targeted use of funds, income and

expenditure books, reports, journal-main, balance sheet and other accounting

documentation are used. This period was the fifth administrative revolution,

which was called the geographical (as a result of geographical discoveries of

the XV-XVII centuries). Its impact on the accounting system manifested itself

in the form of the spread of accounting experience from one country to another,

attempts to harmonize the order of reflection of exchange transactions in

accounting.

Figure 3: Characteristics of

Accounting in Period of the Fourth Administrative Revolution[3]

The sixth administrative revolution,

called the "liknep revolution", took place in the XVI-XVII centuries.

The key event in it was the appearance of the first printing press. Thanks to

the present invention, significant progress has been made in the implementation

of accounts, as a fixed part of the documents began to print, and the variable

- to enter by hand, which initiated the principles of unification of accounting

documents.

The industrial revolution (XVII-XIX

centuries) had a significant impact on the system of public financial

management. After it, management becomes a separate branch of knowledge, its

methods are developed, experience and ability to manage are disseminated. It

was the cause of the seventh managerial revolution (industrial (XVII-XVIII

centuries)), which led to the development of an accounting system focused on

optimizing the use of resources.

In this context, rapid progress in

the development of accounting methodology can be traced in market economies. It

is worth emphasizing that the emphasis is shifting to the theoretical plane,

numerous scientific publications appear, new economic theories are developed,

which are then actively used in practice due to the impact on efficiency. There

are objective grounds for distinguishing between accounting methodology as a

science and practice.

The combination of theory and

practice allows to raise the accounting system to a qualitatively higher level.

At the same time, discussions on the legitimacy of justifying the development

and expansion of accounting functions are intensifying. A simple way to address

the issues is to take into account the objective processes that take place: the

introduction into practice of accounting methods and techniques that

significantly expand its capabilities, including to improve efficiency not only

at the level of individual business entities but also society in in general;

intensification of the use of accounting information for forecasting purposes.

The eighth managerial revolution

(scientific and technical (late XIX - early XX century)). Led to the formation

of management on a scientific basis, which, in turn, gave impetus to the

intensification of research in the field of accounting. The result is the

development of forms of accounting and improving the procedure for its

maintenance, including in institutions that were maintained at the expense of

the budget. At this time there are accounting schools, the science of

accounting is developing, the emphasis is on improving its theory (Figure 4).

Further

historical development of accounting is associated with the need and expansion

of the use of optimization and analytical methods and techniques. Globalization

processes in the world economy, the orientation of the national accounting system

to the principles formed by international accounting standards, limited

financial and logistical support, as well as continuous informatization

inherent in the modern communications system, allows you to quickly manage the

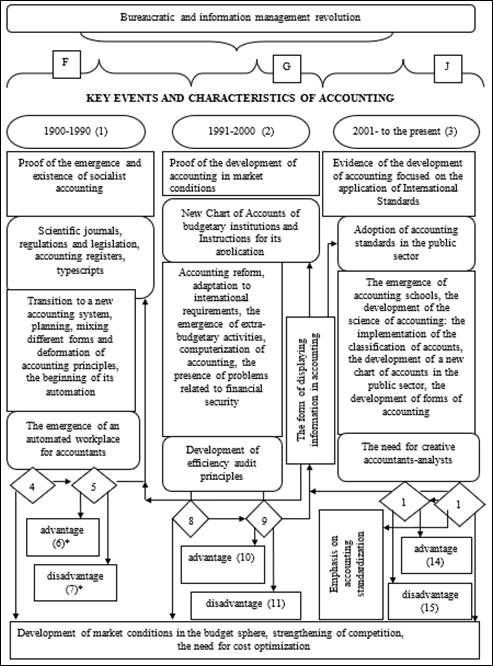

use of resources. The result of the ninth administrative revolution

(bureaucratic (late nineteenth - early twentieth century)) was the

strengthening of the hierarchical structure of government, which led to the

centralization of accounting, strengthening its regulation and subordination to

the interests of the state.

Figure 4:

Characteristics of accounting in the period of the fifth, sixth, seventh and

eighth administrative revolutions[4]

Accounting is aimed at meeting the

requests of higher authorities and monitoring the use of public funds and

property. Rationing is becoming one of the main characteristics of the objects

of accounting. As a result of the development of technical means there is a

gradual automation of accounting, and the desire to unify it and create its

foundations through the approval of uniform forms of accounting documentation

for different entities provides a summary of data by industry and at the

national level.

Planning, characteristic of the

socialist type of economy, had a decisive influence on the accounting. The

relationship between planned and actual indicators made it possible to address

control issues, as planned targets were the norm to accounting.

Accordingly, for the nineteenth

century. characteristic intensification of scientific research in the field of

accounting, as well as the development of accounting scientific schools,

including those focused on the development of the principles of the normative

method of accounting.

At the same time, the purpose of

accounting remained unchanged and was to generate information and report to

higher authorities. At the end of the XX - beginning of the XXI century (Figure

5) accounted for the tenth management revolution (information), which

introduced the use of expert systems, virtual organizations, the widespread use

of electronic communications, the emergence of new organizational forms and

management technologies.

In the XXI century there are

objective prerequisites for intensifying the use of optimization tools. The

actualization of this area of accounting tasks is associated with increased

competition in the budget sphere and further systemic transformation of the

management of entities operating at the expense of budget funds. The latter is no longer associated

with another management revolution, but with the reform of the budget sector,

qualitative changes in the forms, levels and methods of providing services by

budgetary institutions.

Figure 5: Characteristic features of

accounting in the period ninth and tenth administrative revolutions

Table 2: Advantages and disadvantages of the accounting system of post-Soviet

countries and countries with market economies

|

Indicator

/ feature

|

Accounting

system of socialist countries

|

Advantage

/ disadvantage

|

Accounting

system of market economies

|

Advantage

/ disadvantage

|

|

Management system

|

Centralized. Acute hierarchy

of management structure

|

Comparability of indicators,

single Chart of Accounts / Lack of independence. Non-cybernetics of the

accounting system. The growing influence of wrong decisions from top to

bottom and the distortion of information from bottom to top. Too much

centralization. Development of arbitrariness and excess of official authority

|

Democratic

|

Ability to form reasonable

for a particular entity approaches to the composition and content of

accounting indicators / difficulties for comparison

|

|

Content and purpose of

accounting

|

Subordination to the fullest

provision of satisfaction of constantly growing social needs. Control over

the use of state funds and property (means of public control)

|

Representing the interests of

society and citizens / Difficulties in ensuring the implementation of

individual requests. Lack of the right of initiative

|

Satisfaction of management

requests

|

Ensuring proper management of

public and municipal funds / variety of approaches

|

|

Planning

|

Displays the processes of the

planned activity

|

Allows you to monitor

deviations and ensure the achievement of the planned tasks of budgetary

institutions / No disruptions (risks)

|

Market approaches

|

Ensuring the competitiveness

of entities, focusing on market conditions / (many domestic entities do not

carry out strategic planning at all)

|

|

Representation of interests

|

Public

|

Unity of norms and standards

for all / Problems of solving individual requests.

|

States, municipalities and

citizens

|

National and individual

interests, the ability of municipalities to make their own decisions for

citizens of the local community / lack of equal opportunities for all

citizens

|

|

Level of access to

information

|

The data is available to all

managers

|

Sharing and privacy /

Difficulty of operational correction of plans

|

Basic data are available to

the general public, but there is data for internal use

|

Availability of public

control / closure of confidential information to the general public

|

|

The specifics of the property

of social actors

|

State + a number of entities

of social importance were on the balance of industrial enterprises

(kindergartens, hospitals, health facilities, etc.)

|

Partial transfer of the

burden of social issues to the subjects of the production sphere / The

complexity of the redistribution of resources on the cost items and their

justification

|

State and municipal

|

Extensive rights of local

authorities in resolving issues of the territorial community, including in

relation to local taxes and fees / establishing directions of use of funds by

local authorities

|

|

Approaches to regulation

|

The only approach, rules and

forms of accounting

|

Clarity, clarity and

reliability of credentials / Corruption, fear of management and lack of

initiative

|

The presence of the influence

of public Àccounting organizations

|

Freedom in choosing the form

of accounting / problematic formation of statistical indicators

|

Source: Formed by the authors on the basis of generalization of current

accounting practice

The external manifestation of the

systemic transformation of management has affected the sources of financial

support for the provision of services, the organization of accounting for

transactions related to the expenditure of budget funds, the level of autonomy

of the subjects of the budget sphere, and so.

3.2.

Is there a connection between the

transformation of the management system and the development of the Accounting

system?

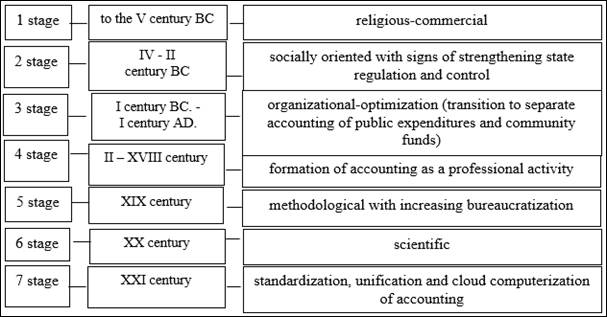

Studies show that the stages of

development of accounting are associated with the transformation of the

management system of business entities, which changes its objectives and

principles. On this basis, 7 stages of the historical development of accounting

in budgetary institutions are identified (Figure 6).

Figure 6: Stages of development of

accounting in the field of public sectors on the basis of the impact of

management system requests

Unification of

accounting nowadays is carried out on the basis of introduction of requirements

of the international standards. The approval on their basis of the National

provisions (standards) of accounting in the public sector is aimed not only at

unifying approaches to accounting, but also involves a change in the philosophy

of budget management. A special role in this context is played by the approved Chart

of Accounts in the public sector, developed on the basis of harmonization with

the budget classification of expenditures.

The emphasis on building

a clear vertical for the reflection of budget funds in the accounts indicates

the desire to strengthen control over their formation and use. From the

standpoint of demonopolization of public sector management, such an approach by

the state is quite logical. Thus, the periodization of the development of

accounting on the basis of the impact of management system requests indicates a

close relationship between changes in accounting characteristics depending on

the transformational changes in management structures. From this follows the

conclusion about the expediency of taking into account the systemic transformation

of the management of budgetary institutions in the development of the

principles of modernization of accounting.

Thus, it should be

emphasized that the results of the genesis of accounting is a necessary

condition for the development of an improved concept, which includes solving

problems of theory, organization and methodology. Our research results indicate

the connection between the transformation of management and the development of

the accounting system.

The characteristics of

accounting, established as a result of the analysis of historical, as well as

economic foreign and domestic sources, indicate the presence of a close

relationship between it and the systemic changes that have taken place in

management.

REFERENCES

Diadiun, O., Petryk, O., Semenyshena, N.,

Khorunzhak, N., & Kalinichenko, S. (2020). Integrated Reporting in the Conditions of Sustainable Development:

Institutionalization through Standardization. Intellectual

Economics, 14(2), 67-86. DOI: https://doi.org/10.13165/IE-20-14-2-02.

Fleischman, R. K., Funnel, W., & Walker, S. (2012). Critical Histories of

Accounting. London: Rout ledge.

Jäger, E. L. (2010). Supplement zu den zwei

Hauptwerken über die Geschichte der Buchhaltung, Nämlich zu 1. Lucas Paccioli und

Simon Stevin, 2. Beiträge zur Geschichte der Doppelbuchhaltung (German

Edition). Publisher: Nabe Press.

Kaplan, R. (1984). The Evolution of

Management Accounting. The Accounting Review, 59(3), 390-418.

Khomyn, P. Ya., & Zhuravel H. P. (2007). Paradyhma y kontroverzy

bukhhalterskoho obliku ta zvitnosti (sproba konsekventnoho analizu):

monohr. Ternopil: Ekonomichna dumka. [in Ukrainian].

Leyerer, C. (1919). Theorie der Geschichte der Buchhaltung. Brunn: M. Trill. Avaible: http://www.buchen.ch/Geschichte_der_doppelten_Buchhaltung.pdf.

Access: 12 August 2020.

Logosha, R., Moroz, I., Semenyshena, N., & Chykurkova, A. (2019). Market Institute:

research methodology in context of basic cognitive approaches. Intellectual

Economics, 13(2), 172-194. DOI: https://doi.org/10.13165//IE-19-13-2-09.

Marks, K. (1885). Kapytal. T. 2. SPb. [in Russian].

Novychkov, N. V.

(2007). Teoryia orhanyzatsyy. Moskow: HUU. [in

Russian].

Omelchenko, M., & Zatoka, L. (1998). Vidobrazhennia kozatskoi doby v Ukraini na

dilovykh paperakh. Novi

doslidzhennia pamiatok kozatskoi doby v Ukraini, 7, 35-39. [in

Ukrainian].

Radchenko, O., Semenyshena, N.,

Sadovska, I , Nahirska, K.,

& Pokotylska, N.

(2020). Foresight Development Strategy of the Financial Capacity: Comparative

Study of the Ukrainian Agricultural Sector. Engineering Economics,

31(2), 178–187. DOI: https://doi.org/10.5755/j01.ee.31.2.24340

Rasid, S. Z. A., Saruchi, S. A., & Tamin R. S. M. (2019). The eminence of the

4th industrial revolution: how it transformed management accountants. Advances in Social Science. Education and

Humanities Research, 308, 186-189. Available: https://www.atlantis-press.com/proceedings/insyma-19/55915458. Access:

15 August 2020.

Razumkov Tsentr (2020). Hromadska dumka naselennia shchodo reformy

detsentralizatsii ta yii rezultativ. Available: https://razumkov.org.ua/napriamky/sotsiologichni-doslidzhennia/gromadska-dumka-naselennia-shchodo-reformy-detsentralizatsii-ta-ii-rezultativ-serpen-2020r. Access:

17 August 2020.

Semenyshena, N., Khorunzhak, N., & Sadovska, I. (2020). Evaluation of the Adaptability of

the Scientific Theories for the Development of Accounting Institute. Intellectual Economics, 14(1), 114-129.

DOI: 10.13165/IE-20-14-1-07.

Semenyshena, N., Khorunzhak, N., & Zadorozhnyi, Z.-M. (2020). The Institutionalization of Accounting: the Impact of National Standards

on the Development of Economies. Independent

Journal of Management & Production, 11(8), 695-711.

DOI: 10.14807/ijmp.v11i8.1228.

Semenyshena,

N., Sysiuk, S., Shevchuk, K., Petruk, I., & Benko, I. (2020). Institutionalism in Accounting: a Requirement of the Times or a Mechanism

of Social Pressure? Independent Journal of Management & Production, 11(9), 2516-2541. DOI: 10.14807/ijmp.v11i9.1440

Slabchenko, M. E. (1925). Orhanyzatsyia

khoziaistva Ukrayny ot Khmelnychchyny do myrovoi voiny. Ch. 1: Khoziaistvo

Hetmanshchyny

v XVII–VIII stoletyiakh. T. 4: Sostav i upravlenye hosudarstvennym khoziaistvom

Hetmanshchyny

XVII–XVIII vv. Odesa: Hos. yzd-vo Ukrainy. [in Ukrainian].

Sokolov, Ya. V. (1995). Bukhhalterskyi uchet:

ot ystokov do nashykh dnei. Moskow: Audyt. [in Russian].

Svirko, S. V. (2006). Bukhhalterskyi oblik u

biudzhetnykh ustanovakh: metodolohiia ta orhanizatsiia: monohr. Kyiv: KNEU.

[in Ukrainian].

ACCOUNTING

INSTITUTE: ON THE GENESIS AND IMPACT OF MANAGEMENT REVOLUTIONS

ACCOUNTING

INSTITUTE: ON THE GENESIS AND IMPACT OF MANAGEMENT REVOLUTIONS