enhanced customer due diligence and customer identification in physical

absence. Each of the ways of identification differs in the scope of collected

personal data, methods of data collection, legal regulation and the use of

technological instruments.

Keywords: Prevention

of Money Laundering; Customer Identification; Customer Due Diligence;

Simplified Customer Due Diligence Measures; Enhanced Customer Due Diligence;

Electronic Signature

1.

INTRODUCTION

As

the market of payment instruments is growing, the choice of a suitable on-line

service scheme becomes an important issue for new players in the market. Newly

emerged FinTech businesses have already updated their business models. So far,

Lithuania has been positioned as a state having an innovative FinTech sector

and encouraging FinTech market players to deliver their services on the

Internet. Distance customer identification is crucial here. Therefore, we face

a constantly growing need to legally regulate the process of distance customer

identification so that not to violate principles of technological neutrality

and functional equivalence.

Customer

identification has become a key element of interior control of financial

institutions since suitable customer identification is essential for financial

institutions to avoid possible misuse and fraud by the client. However, the key

and the most important reason for strict customer identification procedures is

prevention of possible money laundering and financing of terrorism stipulated

in legal acts of the EU.

Strict

standards of the customer identification procedure stem from the directive

91/308/EEC of 1991 on prevention of the

use of the financial system for the purpose of money laundering (Council Directive, 1991), being the first instrument to bind member states to ban anonymous

accounts and anonymous payment cards in their financial and credit

institutions. Thus, financial institutions in all EU member states have no

right to service anonymous accounts.

A few

years earlier, in 1989, Financial Action Task Force was launched with the key

goal to combat shadow economy and monitor new trends and technologies. To

achieve the goal, FATF adopted 40 recommendations on combating money laundering

(Fatf

Recommendations, 2012). In 1996, FATF recommendations were revised in view

of the use of rapidly developing IT technologies for the purpose of money

laundering and of the growing number of electronic payment services companies,

most of which were not even registered as ordinary financial institutions. 130

countries approved and adopted the recommendations, which became the key

standard in anti-money laundering policies.

The

aforementioned FATF recommendations were transposed to the first EU anti-money

laundering directive. In particular, the tenth FAFT recommendation "Financial institutions should be prohibited

from keeping anonymous accounts or accounts in obviously fictitious names. Financial institutions should be required to

undertake customer due diligence (CDD) measures....." makes a serious

challenge for financial institutions and the new FinTech sector – offering

up-to-date financial services by means of digital aids and on-line client

identification procedures. In 2018, the FATF plenary

meeting emphasized the importance of the FinTech sector and the need to

encourage use of new technologies in the financial sector and increase

efficiency of money laundering prevention.(Outcomes Fatf Plenary, 2018)

Importance

of the FinTech sector and development of innovative tools of distance

verification of customer identity have also been emphasized by European Banking

Authority in their official opinion:

"there are innovative solutions that often involve non-face-to-face

verification of customers’ identity on the basis of traditional identity

documents (e.g. a passport, a driving licence or a national identity card)

through various portable devices such as smartphones" (Opinion of 23

JANUARY, 2018).

2.

RESEARCH PROBLEM

The

new challenge closely associates with differences between data processing in

physical and digital environments. In a physical environment, a personal

identification document is enough to verify one's identity. Personal identity

documents issued by the state form legal identity of the holder. The most

important legally acknowledged documents verifying one's identity typically in

a physical environment include an ID card and a passport.

The

latter are granted by authorized national institutions and constitute the only

legally valid identity verification instrument in most member states of the EU

(Prado). Financial institutions in the EU are imposed a duty to duly verify

customer identity in a physical environment (Directive, 2018/843) since

physical identity verification in presence of the customer is deemed more

reliable than that done in their absence. The same approach is typical in most

EU member states including Lithuania. Controlling agencies carefully monitor

identity verification processes and personal data collected by financial

institutions.

However,

the argument that customer identity verification is more reliable in a physical

environment has no serious grounds and has become obsolete. As international

migration has become common place, nation states are facing the need to

introduce reliable tools of personal identity verification and establish a

reliable link between the holder and the document at the moment of crossing the

border, leading the EU to the adoption of a decision on the use of biometric

data as a new standard of personal identification, Minimum security standards

for passports were introduced by a Resolution of the representatives of the

Governments of the Member States, meeting within the Council, on 17 October

2000.

It is

now appropriate to upgrade this Resolution by a Community measure in order to

achieve enhanced harmonised security standards for passports and travel

documents to protect against falsification. At the same time biometric

identifiers should be integrated in the passport or travel document in order to

establish a reliable link between the genuine holder and the document” (Council Regulation No

2252/2004). Biometric data may be collected and used only

within the limited scope of subjects.

Also,

the data may be collected and processed only by a single institution within the

state "In order to ensure that the information referred to is not made available

to more persons than necessary, it is also essential that each Member State

should designate not more than one body having responsibility for producing

passports and travel documents, with Member States remaining free to change the

body, if need be. For security reasons, each Member State should communicate

the name of the competent body to the Commission and the other Member States (Council Regulation No

2252/2004).

Ambitions

to use biometric data recorded in personal identity documents for the purpose

of rendering financial services were blocked by the ECJ decision of 2013

"The regulation not providing for any other form or method of storing

those fingerprints, it cannot in and of itself, as is pointed out by recital 5

of Regulation No 444/2009, be interpreted as providing a legal basis for the

centralised storage of data collected thereunder or for the use of such data

for purposes other than that of preventing illegal entry into the European

Union" (Judgment

of the Court, 2013).

It

has to be acknowledged that technical specifications of personal identity

instruments, such as standards and functioning of biometric data storage, is a

sensitive issue subject to usage limitations. Efficiency of the EU border

protection would be significantly lower if technical specifications of personal

identity instruments became public and available for the purpose of commercial

interaction: "This Regulation should lay down only such specifications

that are not secret. These specifications need to be supplemented by specifications

which may remain secret in order to prevent the risk of counterfeiting and

falsifications” (Council

Regulation No 2252/2004).

The

aforementioned arguments are enough to prevent EU financial institutions from

the use of biometric data recorded in personal identity documents for the

purpose of identity verification in a physical environment.

There

are no objective reasons to argue that physical identity verification by

collecting "relevant copies of identification and verification data"

(Directive

2018/843) is more reliable than the one made by way of

electronic means since (Law of the Republic of Lithuania on Prevention of Money

Laundering and Terrorist Financing).

1) the staff of financial institutions are not experts in forensic document

examination despite the fact that legal acts stipulate the obligation " to

assess appearance of the document checking in particular if the photo,

individual pages or included records have not been changed or corrected".

This is an absolutely declarative norm practically impossible to enforce. The

used legal technique is inappropriate while the standard checking in particular is vague. The required performance takes

special knowledge and expertise possessed by forensic experts and not by front

liners of financial institutions.

2) Employees of financial institutions are technically unable to

authoritatively "assess if the customer (customer's representative) acting

as a natural person has submitted a valid document to the financial institution

or any other authorised individual and identify if the submitted document

contains an authentic photo of the customer". Comparison of the physical

appearance with the photo in the document is not absolutely reliable as

individual people have different face recognition skills and abilities.

Scientific research reveals that such skills are very individual and divergent:

"Understanding the nature of individual differences in ability to perceive

and recognise face identity is of importance in real-life contexts ranging from

eye-witnessing to passport control..../ different aspects of face-perception

abilities to associate with more general tasks in quite specific and

differentiated ways" (Mccaffer, 2018). EU financial institutions

frequently deal with clients of Asian origin and face recognition becomes a

serious challenge to employees of financial institutions responsible for

customer identity verification. Researchers in image recognition argue that

"by assembling a large data set of labelled images and experimenting with

different neural network architectures, we have achieved a remarkable accuracy

75.03%, almost twice as high as the human average accuracy" (Yu Wang, 2016) In other words, a human being is unable to recognize faces with

100%accuracy, which is only a declarative norm practically impossible to follow

without a technical biometric data analysis.

3) EU legal acts lay down a requirement for financial institutions to

collect necessary documents, data and information directly from national data

systems and registers (Directive 2018/843); however, this is enough only to

verify document authenticity and not the dependence to the holder whose

identity is subject to verification.

The purpose of

this article is to focuses on actual legal instruments used by EU financial

institutions and FinTech agencies in the digital environment for client

identification and on major problems faced by FinTech companies rendering

modern financial services. Financial institutions and FinTech agencies often

face the problem of client identification which is of key importance in the

field

3.

METHODOLOGY

Methodologically, this research focuses on the

regulation of prevention of money laundering in the EU and Lithuania, and also

on the understanding of client identification. The authors use qualitative research

methods, such as the method of textual analysis and the analysis of case law.

4.

RESULTS

In

2005 the EU adopted a directive (Directive 2005/60/EC) on the prevention of the use of the financial system for the purpose

of money laundering and terrorist financing including newly introduced identity

verification concepts of due diligence measures and simplified customer due

diligence measures. The concept of simplified customer due diligence measures

entails simplified customer identity verification standards. Strict identity

verification procedures can be omitted where the risk of money laundering is

low.

The

same directive also includes an option of conditional anonymity

applicable in cases of limited sums, payments and e-transactions.

Until

2013, Lithuania's financial institutions had no legal opportunities to verify

customer identity on the basis of their electronic ID, although qualified

electronic signatures were already available at several agencies. In 2013,

Lithuania’s government adopted decision (Resolution NO 942, 2008) to amend the existing identity verification

procedures. The decision allowed

identity verification without physical presence of the customer.

"Financial

institutions and other economic operators shall be entitled to verify identity

of their customer holding Lithuanian citizenship without the physical presence

of the latter, i.e. by way of distance verification on the basis of a qualified

electronic signature solely in cases where the qualified certificate was issued

on the holder's identity verification in their physical presence" (Resolution no 942, 2008).

The

right to use qualified certificates was granted only for Lithuanian citizens

while certificates of non-Lithuanian citizens could not be used even if they

were issued in the EU. Although Lithuania was already taking part in EU's

single identification project STORK, the

essence of which was the opportunity for EU citizens to use their electronic

identity all over the EU, financial services were left out as an exception.

Although

the aforementioned directive of 2015 does not directly refer to distance

identity verification or electronic signature, member states were given an

opportunity to choose to allow customer identity verification on the basis of

documents, data or information collected from a reliable independent source (Directive 2005/60/EC).

It

was the occasion when the a qualified electronic signature was first

acknowledged equivalent to paper documents used by financial institutions for

identity verification before entering into business relationships. Not all

financial institutions opted for the opportunity, but the directive was of

particular importance to electronic financial agencies lacking a developed

physical customer service network.

Amendments

to the directive made in 2018 (Directive 2018/843) stipulated explicitly

that a qualified electronic signature is a suitable means of identity

verification applicable in all member states independently on the customer's

citizenship. The amendments additionally tightened the use of conditional

anonymity in e-commerce transactions leaving member states an opportunity to

choose independently whether to allow anonymous prepaid cards or not: „Member

States may decide not to accept on their territory payments carried out by

using anonymous prepaid cards.“, Lithuania chose to allow the use of such cards

since 2020-07-10. (Law of the Republic of Lithuania on Prevention of Money

Laundering and Terrorist Financing).

Much

more important amendments of the directive were made on distance identity

verification: „identifying the customer and verifying the customer’s identity

on the basis of documents, data or information obtained from a reliable and

independent source, including, where available, electronic identification means,

relevant trust services as set out in Regulation (EU) No 910/2014 of the

European Parliament and of the Council or any other secure, remote or

electronic identification process regulated, recognised, approved or accepted

by the relevant national authorities;“. Apart from specific measures to enforce

the electronic signature, member states are also allowed to independently

choose, regulate, acknowledge and approve processes of electronic

identification.

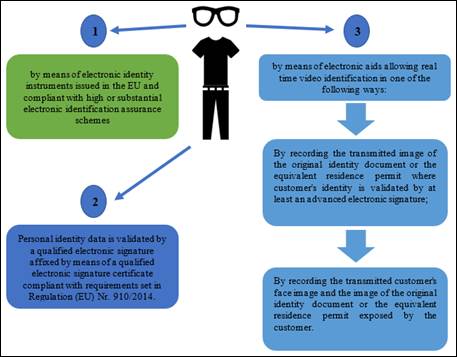

The

amendments of the directive have been transposed into Lithuania's legal system.

(Picture 1). Lithuania's legal acts clearly stipulate the procedure of customer

or beneficiary identification without the physical presence of the latter. The

aforementioned limitation on citizenship was revoked to allow identity

verification of non-Lithuanian citizens by means of electronic identity

instruments issued in the EU and compliant with high or substantial electronic

identification assurance schemes or by means of qualified electronic signature

certificates compliant with requirements set in Regulation (EU) Nr. 910/2014 (Regulation (EU) NO

910/2014). Lithuania's financial institutions may

offer their services to customers holding qualified certificates issued in EU

member states or certificates included in the EU Trusted List of Trust Service

Providers

(Trusted List Browser).

Another

important aspect is that Lithuania's regulation of the use of distance identity

verification still retains a redundant requirement imposing upon a financial

institution an obligation to make sure the electronic signature was issued on

identification of the customer in their physical presence: "customer's

identity was established in customer's physical presence at the moment of

issuance of an electronic identity instrument, compliant with high or

substantial electronic identification assurance schemes, or before issuing a

qualified electronic signature certificate".

.files/image004.jpg)

Figure 1: Requirements for customer or beneficiary identification where the

identity is established without physical presence of the customer or

beneficiary

Source: compiled by the authors

The

very fact of such requirement can make one wonder if Lithuania's legislature

calls into question proper implementation of Regulation (EU) No 910/2014 in EU member states, which is about electronic

identification aids with high security assurance and the qualified electronic

signature issued as an equivalent to a physical document with an equivalent

legal effect.

Regulation

(EU) No 910/2014 states that the security

assurance level should describe the level of reliability of the electronic

identification instrument in identity verification and ensure that an

individual claiming to have a certain identity is actually the person the

identity in question is ascribed to. Minimum

technical requirements, standards and procedures applicable to ensure low,

substantial or high security level should also be paid attention to. According

to the Regulation, a high security level is essential in issuance of qualified

electronic identification certificates.

The

set requirements have to be technologically neutral and possible to meet by

means of various technologies. (Regulation (EU) NO 910/2014). If a qualified electronic signature has been issued by a body

included into EU Trusted List of Trust Service Providers, it may be presumed

that the issuer is of "high security level essential in issuance of

qualified electronic identification certificates" and has unequivocally

verified person's identity before granting a qualified electronic signature.

Financial

institutions are bound by the valid regulation and have to rely on data by EU

Trusted List of Trust Service Providers whereas Lithuania's legal provisions

are in conflict with the position of the EU Commission stating that

"trusted Lists are therefore essential in ensuring certainty and building

trust among market operators as they indicate the status of the service

provider and of the service at the moment of supervision, while aiming at

fostering interoperability of qualified trust services by facilitating the

validation of, among others, eSignatures and eSeals" (Shaping Europe’s

Digital Future).

So

far, Lithuania has retained the requirement for financial institutions to make

certain and ensure that the used identification instrument

is compliant with the aforementioned requirement, that is the customers

identity was verified in their physical presence before granting a qualified

electronic signature certificate. At the same time, it has to be noted that the

responsibility for compliance with requirements set for customer or beneficiary

identification when the identity is verified without their physical presence

lies on the financial institution. Such requirement leads to certain problems:

1) Lithuania's financial institutions cannot

automatically accept EU issued qualified certificates.

2) On receipt of such certificates, the financial

institution has an obligation to inquire data about the identity verification

procedures from the certificate issuer. Also, in customer or beneficiary

identification by means of a qualified certificate and without physical

presence of the customer, financial institutions verifying customer or

beneficiary identification are bound to use additional data, documents or

information allowing verification of the authenticity of the customer's

identity.

EU

citizens are free to use qualified certificates, sign contracts, enjoy public

e-services and access sensitive health data within the entire EU, but they are

actually precluded from the use of financial services in Lithuania.

In

future, customers of financial institutions will be allowed to use a simpler

way of distance identity verification by means of electronic tools allowing

real time video identification (Picture 1). However, such way entails a problem

of matching the transmitted video image to the image contained in the document.

When matching is done visually, we face the problem of reliability, which has

already been discussed in the article.

Most of EU member states rely upon distance identity verification

techniques based on image transmission.

In

customer or beneficiary identification without physical presence of the

customer, financial institutions are bound not only to ascertain and verify

identity of the customer or beneficiary, but to refer to additional data,

documents or information necessary for the purpose of customer or beneficiary

identification and allowing verification of the authenticity of the customer's

identity and find out if there are grounds to apply enhanced identity

verification as well.

The

requirement to use additional data applies in all cases including those where a

secure electronic signature is used. Even when it is known that a person's

physical presence during their identity verification cannot grant absolute

accuracy of identification, but there is no additional requirement of mandatory

verification of the beneficiary's identity, client identification is presumed

to have been properly verified in cases of inter-institutional money transfers

and there is no obligation for the receiving institution to additionally verify

beneficiary's identity. Moreover, the grounds for the receiving institution to

claim customer's personal data from the transferrer remain uncertain.

When

money is transferred to your account from another financial institution, your

personal identity data, verified with due diligence by your account provider,

are not normally passed to the transferring financial institution. However, if

the customer opts for distance identity verification, any operations will be

carried out only on approval of the recipient's identity, which can hardly be

done without violation of principles of personal data protection.

A

uniform practice in the field is absent – financial institutions rely upon

individual solutions of distance customer identification.

Lithuania's

supervisory bodies are reluctant to go deeper into the problem and legal

grounds to claim recipient data without the consent of the recipient are still

absent. For example, if a fixed sum is transferred within the eurozone by means

of EU payment systems, the data necessary for the transaction include an IBAN

number and the purpose of payment whereas the name and the surname of the

recipient are not mandatory. Where the transfer is between EU financial

institutions, the sum will be transferred to the recipient's account on

submission of any name. Thus, the most important identifier in money transfer

within the eurozone is the IBAN number.

Practical

implementation of the requirement to identify the beneficiary becomes rather

complex as it is uncertain which body has to supply the data. The receiving

financial institution cannot disclose personal data of the IBAN holder on

request by the sending institution. Even when the sending financial institution

requests the sender to submit data on the beneficiary, there are no legal

grounds for the sending institution to disclose personal data without their

customer's consent. Financial institutions find themselves in a situation where

the redundant requirements become impossible to meet and the provider of

financial services is actually forced to violate legal regulations and risk

facing a penalty.

Although

the new directive of 2018 (Directive, 2018/843) granted wider opportunities to use distance identity verification, safe

electronic recognition tools of the same legal force and effect, a qualified

electronic signature and a possibility to choose means of real time video

identification, financial institutions chose to implement different technical

solutions (European

Commission Directorate-General For Financial Stability, Financial Services and

Capital Markets Union, 3 (2019) (Table 1).

Another

strict requirement valid in Lithuania concerns cases of distance identification

of residents of third countries rated by European Commission as high risk

countries (European

Commission, 2019). Where the customer is resident of any of

the aforementioned 23 countries, Lithuania's financial institutions are

instructed to mandatory ensure that "the first payment by the customer be

made through an account in the customer’s name with a credit institution

registered in an EU member state or a third country stipulating requirements

equivalent to parallel requirements laid down in the present Act and monitored

by competent supervisory bodies"

It

has to be noted that Directive (EU) 2018/843 provides that „Member States may

require obliged entities to ensure, where applicable, that the first payment be

carried out through an account in the customer’s name with a credit institution

subject to customer due diligence standards that are not less robust than those

laid down in this Directive”.

Words

"ensure, where applicable" are

of key importance here. In other words, such payment may be requested if

necessary, in case of a specific customer, but not in all cases. Why Lithuania

chose to impose the requirement universally remains uncertain. Also, the

directive refers to credit institutions and not to financial in general,

meaning that customers of electronic money institutions are even unable to make

such payment until they open a bank account in one of EU member states. For

example, a customer in Tunisia is unlikely to have an account in a European

bank and there is still no approved list of third countries complying with EU

standards of anti-money laundering.

It

is unclear why Lithuania's legislator has chosen such model. It actually

hinders development of modern FinTech services (as registration in Lithuania

entails applicability of Lithuania's legal regulation).

Why

physical identity verification is deemed more reliable than online also remains

in question. Why is additional data needed for distance identification by a

secure electronic signature, when the electronic certificate already contains

all necessary personal data? Why is video identification subject to additional

requirements although the identity document may be clearly exposed here and

modern technologies allow comparison of unique biometric data, which is

impossible in the physical environment where identification is deemed more

reliable?

Table 1: The main obstacles for involvement of

respondents in eLearning

|

NETHERLANDS

|

Video identification or

equivalent technique is associated to automatic transfer

data from the id document to

the relevant (liveness check)

|

|

UNITED

KINGDOM

|

Video Identification is used

in association with electronic verification Remote onboarding is used

primarily by newer, challenger banks who are online only and do not have

branch network.

|

|

BELGIUM

|

Use of video identification

is possible since Customer ID should be verified against one or more

supporting documents or reliable and independent sources of information which

enable obliged entities to confirm this data

|

|

LUXEMBOURG

|

Video identification

permitting the delivery by Luxtrust of eIDAS-qualified electronic signature

services

|

|

FRANCE

|

Video identification +

biometry is used (Currently no regulation governs video identification. A

regulation on remote onboarding which will validate an eIDAS scheme is being

prepared. Both substantial and high e-ID will be in scope of the regulation.

Solutions are based on picture comparisons between the picture contained in

an official identity paper (passport or id card) and a selfie.)

|

|

LIECHTENSTEIN

|

Video identification

|

|

ITALY

|

Video identification and

biometrics or other technology solutions

|

|

PORTUGAL

|

Use of video conference

(e.g. Caixa Geral de Depositos) in addition with biometrics (Banco BNI

Europa) For these use cases, the legislation requires financial institutions

to have a person, in real time, validating the client’s identity.

|

|

SPAIN

|

Video identification systems

is used. In some cases, in addition with electronic signature. Regulation is

in place for both attended and unattended video identification. Widely used

for mobile on-boarding by most banks and in some cases also for web-based (BBVA,

Santander, OpenBank, ImaginBank, Self Bank, Evo Banco and Bankia)

|

|

GERMANY

|

Pursuant to BaFin Circular

3/2017 Video-Identification is a recognized form of identification procedure

in accordance with the AML Act in Germany

|

|

ESTONIA

|

Video identification (can be

completed with biometrics)

|

|

LATVIA

|

Video identification

(acquisition of data accrediting the identity of a natural person from a

credit institution or payment institution)

|

|

POLAND

|

Use of Video-identification

with or without biometry

|

|

SLOVAKIA

|

Video call identification

(via special application of the bank)

|

|

AUSTRIA

|

Identification through

video-chat has been approved by the Austrian Financial Market Authority (FMA)

on 3 January 2017.

|

|

ROMANIA

|

Video identification.

|

|

HUNGARY

|

Real time video

identification via comparison of the ID photo with the of customers. Used by

OTP Bank, Gránit Bank, Takarék Kereskedelmi Bank, Cofidis Bank,

MKB Bank.

|

|

SLOVENIA

|

Video identification +

Identity card check is permitted to on board customer for account opening.

|

|

MALTA

|

Video Identification: The

(prospective) customer’s identity is verified during a video conference call

|

Source: adapted from Report on existing

remote on-boarding solutions in the banking sector

The

number of EU countries where financial institutions introduce modern identity

verification aids is growing. Legal environment has become favourable to

FinTech development. However, legal regulation in Lithuania is still limiting

development of the service. Lithuania has been positioning itself as a FinTech

leader in the UE (Lithuania’s

Impressive Fintech Growth Extends, 2020) emphasizing clarity, transparency and rapidness of licensing essential

for FinTech businesses. However, the disproportionate legal regulation of the

process of identity verification in the electronic environment may trigger

problems forcing FinTech companies to move their business outside Lithuania.

FinTech

business is not limited by national boundaries and trade their services in the

electronic environment to customers from all over the EU and even outside the

EU. FinTech companies working in the sphere of e-money and e-payment may be

drawn as an example (Picture 2). If they had started in Lithuania, they would

not be able to offer their services outside Lithuania as successfully as they

are doing now from other countries. The success directly depends on legal

regulation of identity verification, application of additional requirements and

newly introduced practices.

.files/image006.gif)

Figure 2: FinTech companies using

video identification as a means of identity verification

Source: Compiled by the authors

5.

CONCLUSIONS

Lithuania

has been positioned as a state with a FinTech-friendly environment. However,

its national legal acts and practices of supervisory bodies impose

disproportionate regulation of identity verification procedures in the

electronic environment. The physical process of identity verification is given

a priority as more reliable than distance identification – a conclusion arrived

at having analysed requirements set upon the identity verification procedure.

The

distance identity verification procedure based on a secure electronic signature

issued in the EU is being hampered by an excessive requirement to make sure the

electronic signature was issued on identification of the customer in their

physical presence. It seems that Lithuania's legislature calls into question

monitoring and performance of secure qualified electronic signature issuers

even where the issuer complies with requirements stipulated by the European

Commission.

In

case of video identification, customers face additional requirements to disclose

personal data of third-party beneficiaries along with submission of their own

personal data, which is already present in the submitted documents, although

the requirement is absent in case of physical customer identification.

Directive

(EU) 2018/843 provides the right of nation states to use their own discretion

in deciding on the applicability of enhanced identity verification and the

requirement to make the first payment through an account at a bank registered

in the EU. However, the provision "may require obliged entities to ensure,

where applicable" has been transposed to Lithuania's legislature as the

requirement" to ensure that the first payment by the customer be made

through an account in the customer’s name with a credit institution registered

in an EU member state or a third country stipulating requirements equivalent to

parallel requirements laid down in the present Act and monitored by competent

supervisory bodies.

At

the moment of writing this article, there was still no approved list of third

countries complying with EU standards of anti-money laundering.

REFERENCES

Biometric passport

Fingerprints Regulation (EC) No 2252/2004 Article 1(2)

Cardoso, W.; Azzolini, W.; Bertosse, J.F.; Bassi, E.; Ponciano, E.S.(2017). Digital

Manufacturing, Industry 4.0, Clould Computing and Thing Internet: Brazilian

Contextualization And Reality. Independent Journal of Management & Production, 8(2), 459-473.

DOI: 10.14807/ijmp.v8i2.572.

Council Directive of

10 June 1991 On

prevention of the use of the financial system for the purpose of money

laundering (91/308/EEC).

Council Regulation

(EC) No 2252/2004 Of 13 December 2004 On Standards for Security Features and Biometrics in Passports and

Travel Documents Issued by Member States THE COUNCIL OF THE EUROPEAN UNION.

Directive (EU)

2018/843 of the European Parliament and of the Council of 30 May 2018 amending

Directive (EU) 2015/849 On the prevention of the use of the financial system for the purposes

of money laundering or terrorist financing, and amending Directives 2009/138/EC

and 2013/36/EU (Text with EEA relevance) PE/72/2017/REV/1.

Directive 2005/60/EC

of the European Parliament and of the Council of 26 October 2005 on the prevention of the

use of the financial system for the purpose of money laundering and terrorist

financing.

Directorate-General

For Financial Stability, Financial Services and Capital Markets Union. December 2019.

European Commission

adopts new list of third countries with weak anti-money laundering and

terrorist financing regimes. Today, the Commission has adopted its new list of 23 third countries

with strategic deficiencies in their anti-money laundering and

counter-terrorist financing frameworks. Avaible: https://ec.europa.eu/commission/presscorner/detail/en/IP_19_781.

FATF Recommendations 2012 - adopted on 16 February 2012

and updated regularly since.

Ghotbifar, F.; Marjani, M.; Ramazani, A. (2017). Identifying and Assessing the

Factors Affecting Skill Gap in Digital Marketing in Communication Industry

Companies. Independent

Journal of Management & Production, 8(1), 1-14. DOI: 10.14807/ijmp.v8i1.507.

Gurgu, E., Gurgu, I.A., & Tonis, R.B.M. (2020). Neuromarketing for a

Better Understanding of Consumer Needs and Emotions. Independent Journal Of Management & Production, 11(1), 208-235. DOI: 10.14807/ijmp.v11i1.993.

Judgment of the Court

(Fourth Chamber) 17 October 2013 (*1 ). Reference for a preliminary ruling Area of freedom, security and

justice.

Laurinaitis, M., Stitilis, D., Rotomskis, I.,

Azizov, O., & Marchuk, N. (2020). Limitations of the

Concept of Permanent Establishment and E-commerce. Independent Journal of Management & Production, 11(9), 2308-2324. DOI: http://dx.doi.org/10.14807/ijmp.v11i9.1429.

Law Amending Article

168 of the Code of Criminal Procedure of the Republic of Lithuania. Document No. VIII-275. Amendments

no. XIII-2584, 03/12/2019, published in TAR on 19/12/2019.

Law of the Republic of

Lithuania on Prevention of Money Laundering and Terrorist Financing no.

VIII-275 2, 4, 5, 7, 8, 9, 10, 11, 12, 13, 14, 15, 17, 19, 20, 21, 22, 23, 24,

25, 26, 27, 28, 29 , 48, 49, 51 and the Law amending and supplementing the

Annex with Articles 71, 141, 251, 252. (2019). December 3 No. XIII-2584, Vilnius.

Lithuania’s Impressive

Fintech Growth Extends (2020). Available: https://investlithuania.com/news/lithuanias-impressive-fintech-growth-extends-into-2020/.

Access: 11 September 2020.

Mccaffery, J. M., Robertson, D. J., & Young, A. W. (2018). Individual differences in face identity

processing. Cogn. Research,

3, 21. https://doi.org/10.1186/s41235-018-0112-9.

Opinion of 23 January

2018 on the use of innovative solutions by credit and financial institutions in

the customer due diligence process. European Banking Authority.

Prado - Public

Register of Authentic travel and identity Documents Online. European Parliament. European

Commission.

Puraite, A., Zuzeviciute, V., Bereikiene, D.,

Skrypko, T., & Shmorgun, L. (2020).

Algorithmic Governance in Public Sector: Is Digitization a Key to Effective

Management. Independent Journal of Management &

Production, 11(9), 2149-2170. DOI: http://dx.doi.org/10.14807/ijmp.v11i9.1400.

Regulation (EU) No 910/2014 of the European Parliament and of the

Council of 23 July 2014 on electronic identification and trust services for

electronic transactions in the internal market and repealing Directive

1999/93/EC.

Resolution No 942 of

24 September 2008 on the List of criteria for considering a customer to pose a

small threat of money laundering and/or terrorist financing and criteria based

on which a threat of money laundering and/or terrorist financing is considered

to be great. On the

approval of the rules of customer and beneficial owner identification as well

as detection of several interconnected monetary operations, and on the establishment

of the procedure of presenting information on the noticed indications of

possible money laundering and/or terrorist financing and violations of the Law

of the Republic of Lithuania on prevention of money laundering and terrorist

financing as well as the measures taken against the violators. (has been

revoked).

Shaping Europe’s

Digital Future.

Policy. EU Trusted Lists. European Commission.

https://ec.europa.eu/digital-single-market/en/eu-trusted-lists-trust-service-providers

Stitilis, D., Rotomskis, I., Laurinaitis, M.,

Nadvynychnyy, S., & Khorunzhak, N. (2020).

National Cybersecurity Strategies: Management, Unification and Assessment. Independent Journal of Management &

Production, 11(9), 2341-2354. DOI: http://dx.doi.org/10.14807/ijmp.v11i9.1431.

The Financial Action

Task Force (2018). Outcomes FATF Plenary, 17-19 October

2018.

Trusted List Browser. Tool to browse the national eIDAS Trusted Lists

and the EU List of eIDAS Trusted Lists (LOTL). Avaible: https://webgate.ec.europa.eu/tl-browser/#/.

Access: 15 September 2020.

Validity Legal basis

Procedure for adopting. Articles 7 and 8 of the Charter of Fundamental Rights of the European

Union Right to respect for private life Right to the protection of personal

data Proportionality.

Viltard, L.A. (2016). Unlimited, Blurred limits in a borderless world. Independent Journal of Management &

Production, 7(2), 380-412. DOI: dx.doi.org/10.14807/ijmp.v7i2.417.

Yu Wang, Haofu Liao, Yang Feng, Xiangyang Xu, & Jiebo Luo (2016). Do

They All Look the Same? Deciphering Chinese, Japanese and Koreans by

Fine-Grained Deep Learning. Department of Computer Science.

University of Rochester, NY, USA. arXiv:1610.01854v2 [cs.CV]. 23 Oct 2016.

DISTANCE

PERSONAL IDENTIFICATION IN THE ON-LINE ENVIRONMENT: PROBLEMS OF FINANCIAL

INSTITUTIONS IN THE EU

DISTANCE

PERSONAL IDENTIFICATION IN THE ON-LINE ENVIRONMENT: PROBLEMS OF FINANCIAL

INSTITUTIONS IN THE EU.files/image004.jpg)

.files/image006.gif)